A home equity loan is usually a greater alternative than a cash out refinance should you don’t want to change your present mortgage — maybe for the reason that you have already got an extremely-very low interest charge or since you’re near having to pay the original loan off.

Test to carry lots of more compact notes with you as outside of big outlets and eating places it can be tough to modify 500/a thousand notes. Don’t endeavor to purchase modest worth things, taxis or tuk-tuks with significant-worth notes.

What credit history score do you want for just a cash-out refi? The bare minimum credit rating you would like for the cash-out refinance is often 620.

Its Principal intention is always to lower your regular monthly home loan payments or to modify you from an adjustable-price to a fixed-amount home loan.

Remember the fact that you won't have to keep on with your existing lender after you refinance, and given that rates, terms and fees can vary, comparison searching is a great move.

Every sort of loan has its own unique benefits and considerations. It’s critical to comprehend these variances to produce an knowledgeable determination that aligns along with your money goals.

And with Faucet to Provision, it’s even simpler for people so as to add a credit or debit card to Apple Wallet simply by tapping their suitable card to your back in their apple iphone.five

Beware of poor exchange charges. Banking companies get more info and conventional providers frequently have more fees, which they pass to you personally by marking up the exchange rate. Our clever tech signifies we’re a lot more productive – which implies you can get a terrific level. Each and every time.

HELOC. That is a form of revolving credit score that lets you continuously attract from and pay back a credit history line—just like a bank card. You’ll normally have five to 10 years to access cash with a HELOC though spending only the fascination, then an extra ten to 20 years to repay That which you borrowed, as well as interest.

Does a cash-out refinance affect your credit score rating? Aside from a little ding for possessing your credit score pulled, a cash-out refinance isn't going to impact your credit score rating.

Common cash-out refinance: When you've got a DTI ratio beneath fifty%, an LTV ratio beneath eighty%, as well as a FICO score of 620 or more, a conventional cash-out refinance could possibly be perfect. Using this type of loan, you will not be necessary to shell out home loan insurance plan

Supplying an employer contact number substantially will increase your probability of obtaining a mortgage. If you're on Positive aspects, You can utilize the contact number of The federal government Business that gives your Gains. Enter Employer Telephone

And it’s also why Apple Fork out was intended to protect people’ extremely sensitive private and monetary info, like their card amount, which is rarely shared with merchants. Our clients have faith in that every time they use Apple Pay anyplace, they will hold the assurance that their payments are guarded.

Verify which has a number of lenders to find your best cash-out refinance price in these days’s industry. Time for making a move? Allow us to come across the right house loan for yourself

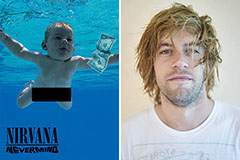

Spencer Elden Then & Now!

Spencer Elden Then & Now! Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!